|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ultimate Auto Protection: Coverage Guide for U.S. ConsumersWhen it comes to ensuring your vehicle's longevity and safeguarding against unexpected repair costs, understanding ultimate auto protection can be a game-changer. For U.S. consumers, navigating the world of vehicle protection plans and extended warranties can seem daunting, but this guide will help clarify your options and the benefits of securing your investment. Why Consider Ultimate Auto Protection?With repair costs on the rise, especially in cities like Los Angeles and New York, having a robust protection plan is not just a luxury-it's a necessity. Here are a few compelling reasons why:

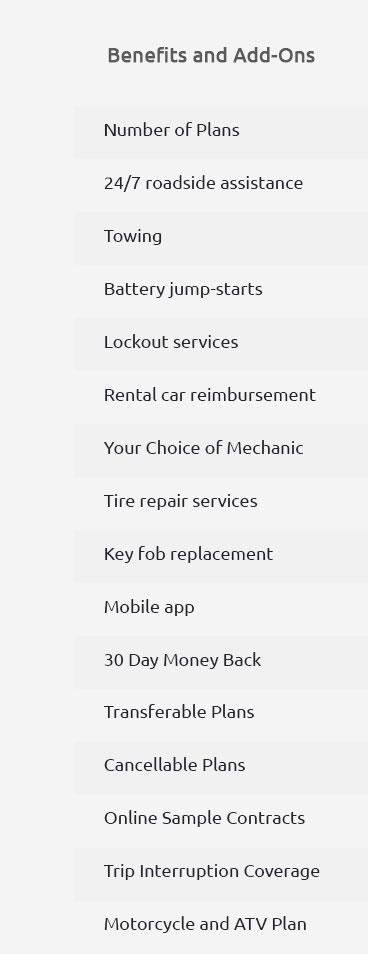

What Does Ultimate Auto Protection Cover?Understanding what is typically covered under ultimate auto protection is crucial. Here’s a breakdown: Common Components Covered

Additional Benefits

Exploring different providers can yield plans that best suit your needs. For example, a chevy impala extended warranty could offer specific advantages for that model. Cost ConsiderationsWhile upfront costs might seem significant, the long-term savings and security make it worthwhile. Costs vary based on vehicle make, model, and mileage. Comparing options is key; you might want to compare extended car warranties to find the best fit for your budget. FAQWhat factors influence the cost of ultimate auto protection?The cost is influenced by the vehicle's age, mileage, and the level of coverage selected. Additional features like roadside assistance can also affect the price. Is ultimate auto protection available for older vehicles?Yes, many providers offer plans for older vehicles, though the terms and coverage may vary. It's important to check the specific offerings for vehicles like those over ten years old. Can I transfer my auto protection plan if I sell my car?Most plans are transferable, adding value to your vehicle when selling. However, terms can differ, so verify with your provider. By investing in ultimate auto protection, U.S. consumers can enjoy peace of mind and financial security, ensuring their vehicle stays on the road for years to come. https://www.bbb.org/us/ca/woodland-hills/profile/auto-service-contract-companies/ultimate-auto-protection-1216-704894

Ultimate Auto Protection is NOT a BBB Accredited Business. To become accredited, a business must agree to BBB Standards for Trust and pass BBB's vetting ... https://www.mapquest.com/us/california/ultimate-auto-protection-650141872

Ultimate Auto Protection is a reputable automotive service provider based in Woodland Hills, CA. The company specializes in offering ... https://ultimateauto.com/paint-protection/

Ultimate Auto's Paint Protection service offers advanced solutions to safeguard your vehicle's paint from environmental damage, scratches, and wear.

|